An annual net performance of over 10% for more than 7 years.

⬇

Past performance does not guarantee future results and should not be interpreted as a promise of future performance or returns.

Top performing return

Past performance does not guarantee future results and should not be interpreted as a promise of future performance or returns.

Watch the interview with the founder of Phocus1

From High-Yield liquid savings to hedge fund

Phocus1 generates Alpha (outperformance compared to the market) without relying on traditional financial products such as stocks, bonds, ETFs, REITs, and others.

Discover with Phocus1 how to invest in currencies in 2025 for a high-yield investment.

Our aim

Deliver higher performance than traditional investments, to offset inflation.

Our expertise

Having the expertise to profit from daily swings in currency rates.

Our performance

Our profitability categorizes us as one of the leading existing investment choices.

Phocus1 shields investors from the three major risks of 2025.

Introducing innovative features to enhance your investment experience

A diversified currency alternative investment fund

Phocus1 offers an alternative cash investment solution by daily trading currency pairs from major Western economies: US Dollar, Canadian Dollar, Australian Dollar, British Pound, Japanese Yen, Euro, and Swiss Franc (CHF).

The portfolio is diversified across currencies with the highest quality, full liquidity, and low volatility. Phocus1 does not invest in stocks, treasury bills, bonds, ETFs, cryptocurrencies, or any other financial market products. Our investment strategy is 100% currency-based and 100% liquid.

Active management for day-to-day performances

To deliver exceptional annual returns on currencies, we leverage the winning strategies of banks and leading global funds: real-time automated alert systems, innovative hedging processes, and advanced risk management techniques.

By operating continuously, even the slightest signals in currency markets are captured, turning them into small potential gains while limiting potential losses.

Attractive taxation applicable only upon exit

Your investment consists of purchasing shares in our Luxembourg Alternative Investment Fund (AIF), whose value fluctuates over time.

As a result, you do not pay taxes on annual profits as long as you do not liquidate your assets.

You thus benefit from tax-free compound interest. Remarkably, based on our past performance, you can double your capital in just 6 years.

No fees, only performance-based commissions

We are the new generation of innovative financial funds. You pay no entry, management, or exit fees.

We are solely compensated based on the gains achieved, taking a percentage of those profits, ensuring our interests are aligned. When you win, we win.

Our goal is to deliver profitability on your savings.

You win, we win.

Questionnaire, are you a well-informed investor?

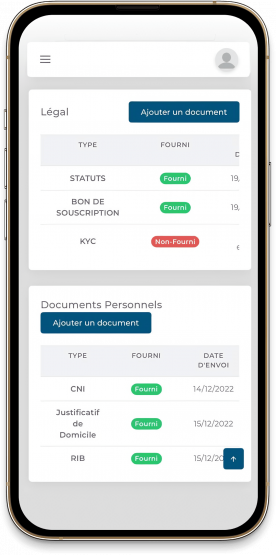

A transparent investment

- Private PhocusInvestment clarity is just a click away: monitor your funds via your personal online dashboard.

- Real-time performanceDay-to-day and monthly gains, NAV (Net Asset Value), historical data.

- Monitoring of capital and profitsNumber of units, subscription dates, investment horizon and values of held assets

- Your key papers in one placeSubscription form, Share certificate, KYC, all consolidated for straightforward Luxembourg financial compliance. everything is centralized to comply with Luxembourg's financial regulations.

« As a direct investor in the currency market for several years, I decided to create Phocus1 in 2019 to offer clients of my retirement consulting firm, EOR, the opportunity to boost their pensions alongside me »

Interested? I invite you to join our next meeting.

Join our upcoming webinar

High-yield retirement investment strategy

Q&A

You can access Phocus1 starting at €125,000, in compliance with Luxembourg AIF (Alternative Investment Fund) regulations.

NOTE: This is not a tiered investment structure. You can invest €130,000 or €150,000, for example, as long as the amount exceeds €125,000.

Your money is not locked in; it remains liquid and accessible at any time. The investment horizon is set at 12 months, meaning you can realize your gains after this period. However, if you wish to withdraw your funds before 12 months, it is possible, and the performance-based commission will be adjusted accordingly.

Yes, provided that your insurer or bank has included the option to subscribe to Alternative Investment Funds (AIFs) in your policy agreement.

No, investing in Phocus1 means acquiring shares in our investment fund. The value of each share is reassessed monthly, accurately reflecting the current value of your gross assets. You can track the progress of this valuation in real-time through your client portal.

There are no entry, management, or exit fees. Our compensation comes solely from performance-based commissions on gains achieved during your investment period. This means 100% of your deposits are invested to maximize your returns.

Find all the details in your investor portal.

As a shareholder, you have access to an investor portal and a dedicated section to monitor the progress of your deposits, withdrawal dates, realized gains, and the fund’s performance in real-time. A mobile app is also available, allowing you to manage your investments easily from anywhere.

Create your account by clicking here.

You will then be able to download our prospectus, management reports, and other documents.

For any questions, contact us at: info@phocus1.com